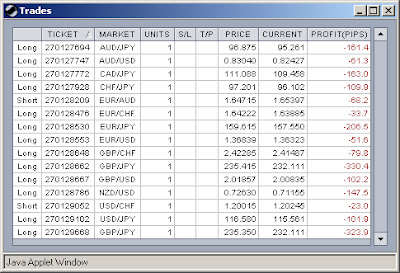

Here is the result of my recent trades. Its a bummer.

Lately I am feeling that I am not in tune with the markets and also life in general. I am pondering with the question of why I cannot learn forex trading and be a winner rather than keep on losing on and on.

Then a realization hit me that I had not been putting my 100% into learning forex. I am not practicing trades as I should have. I thought that I have no reason to say that I am a failure in forex after I failed once or twice or so many times because I still have not done any homework yet. I cannot fail if I still have not done anything yet. The only time that I can say that I failed is when I have already done everything and I still keep losing. Then all my effort have gone to naught, it is then shall I know that I have failed.

But for now I say, Keep on learning and keep on paper trading!